felo-gert.ru

Prices

How Do You Pay Yourself Out Of An Llc

How to pay yourself as an LLC, sole proprietor, or corporation · sole proprietorship or partnership, in which case you simply draw cash from profits · corporation. Additional Ways to Pay Yourself from an LLC: · Bonuses Based on Performance: Implement a system where you receive bonuses based on specific performance metrics. Because an LLC is a pass-through entity, the process is relatively simple for a single-member LLC. The owner can simply draw the money out, provided he or she. Profit distributions as a salary An alternative method is to pay yourself based on your profits. The SBA reports that most small business owners limit their. File a w4 for yourself and add yourself to your LLC's payroll. If you have a business account with any banks, they offer simple payroll service. Each member of the LLC will pay themselves through an owner's draw, or multi-member LLCs can set up regular payments that would function as a salary. Multi-. If the LLC has opted to be treated as an S corporation for taxes, then there's another way you can take money out of the company: You can split your pay between. When an LLC is taxed as a corporation, owners can pay themselves a salary from the LLC's income. This method is a bit more complicated than the owner's draw. You should give serious consideration to how you withdraw funds from your business enterprise. Usually, there are two options for doing that: a salary or an. How to pay yourself as an LLC, sole proprietor, or corporation · sole proprietorship or partnership, in which case you simply draw cash from profits · corporation. Additional Ways to Pay Yourself from an LLC: · Bonuses Based on Performance: Implement a system where you receive bonuses based on specific performance metrics. Because an LLC is a pass-through entity, the process is relatively simple for a single-member LLC. The owner can simply draw the money out, provided he or she. Profit distributions as a salary An alternative method is to pay yourself based on your profits. The SBA reports that most small business owners limit their. File a w4 for yourself and add yourself to your LLC's payroll. If you have a business account with any banks, they offer simple payroll service. Each member of the LLC will pay themselves through an owner's draw, or multi-member LLCs can set up regular payments that would function as a salary. Multi-. If the LLC has opted to be treated as an S corporation for taxes, then there's another way you can take money out of the company: You can split your pay between. When an LLC is taxed as a corporation, owners can pay themselves a salary from the LLC's income. This method is a bit more complicated than the owner's draw. You should give serious consideration to how you withdraw funds from your business enterprise. Usually, there are two options for doing that: a salary or an.

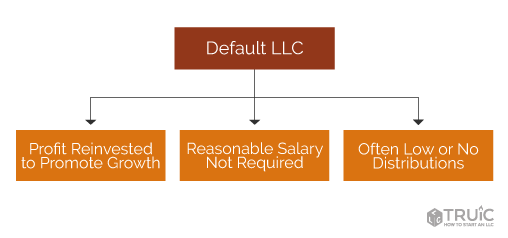

You will be considered a W-2 employee of the LLC. This means that every time you pay yourself, taxes will be taken out just like with a normal job. If you. Most LLC owners pay themselves with owner distributions. Additional rules apply when LLCs are taxed as S-Corporations or C-Corporations. As the owner of a business, if you take money out of the business for your personal use, this is called the owner's draw. If you have chosen to create a single-. To get paid, LLC members take a draw from their capital account. Payment is usually made by a business check. They can also receive non-salary payments or “. Your second option is to take staggered payments based on the Florida LLC's expected annual profits. Those payments will be deducted from the company's actual. Because an LLC is a pass-through entity, the process is relatively simple for a single-member LLC. The owner can simply draw the money out, provided he or she. If small business owners pay themselves via a salary, both federal and state taxes are automatically taken out of their paychecks, so they don't have to file. Just write a check to yourself and deposit it into your personal account. Keep in mind that you will pay a separate tax on that money. I never. As an owner of an LLC, you'll pay yourself with an owner's draw. To safeguard your liability protection, you'll need to do your best to keep personal and. In the early years of owning a single-member LLC, you'll pay yourself with checks or online transfers from your LLC's business bank account to your personal. Corporation owners can either pay themselves a salary through payroll or dividends, or a mix of both. The salary shows as an expense on the business books and. The owner's draw has the benefit of a flexible payout. Basically, you can take money out of the company whenever you want. There's no ongoing expense for the. You do not pay self-employment taxes on the amount that you take out as your distribution and you don't actually need to take a distribution. It's just whatever. If you're a sole proprietor, a partner in a partnership, or a member of a standard LLC, you'll likely pay yourself with an owner's draw. This is the most. Most LLC owners pay themselves with owner distributions. Additional rules apply when LLCs are taxed as S-Corporations or C-Corporations. First off, you'll need to pay taxes for everything the company earns, regardless of funds drawn. Secondly, since you're considered the LLC's sole proprietor. Wages and Salaries. Another way to pay yourself from your LLC is to take a salary or give yourself a wage. This is similar to how traditional employees are paid. If you are under the default classification and have not elected to be taxed as a corporation, you cannot receive a salary from an LLC. Instead, you withdraw. Generally, you'll pay yourself by taking an owner's draw, which transfers a percentage of your LLC's income to you as a wage. Single-member LLC owners pay themselves with what is called an owner's draw. To make an owner's draw, you simply write yourself a check from your business.

How Can You Transfer Money To Another Bank Account

1) From the Transfer money page, select the External account transfers tab. 2) Enter the amount you want to transfer, the accounts you want to transfer from and. WorldRemit specializes in remittance transfers, which is simply another way of saying “money transfer”. WorldRemit is an excellent choice for moving money. Use your fingerprint to securely log in. · Select Pay & Transfer then Transfer between my accounts. · Select the account you want to transfer From and then the. Log OnLog On This link will open in a new window to Personal Internet Banking · Under the 'Move Money' section, click 'Bank-to-Bank Transfers' on the left. A bank account transfer works when a person instructs their bank to send money directly into another bank account. This is usually done electronically via. How to add and use external accounts. STEP. 1. Sign in to Associated Bank Digital. STEP. 2. Select “Transfers” and then “Manage Account” on your mobile device. To transfer funds between your accounts: Sign on to Wells Fargo Online to access transfers. Choose the account you want to transfer money from, the account you. External transfer services are available for most personal checking, money market and savings accounts. To use these services you must have an Online Banking. A cashier's check is probably the safest way to transfer a large sum of money between two banks. It is also relatively fast and secure, so it. 1) From the Transfer money page, select the External account transfers tab. 2) Enter the amount you want to transfer, the accounts you want to transfer from and. WorldRemit specializes in remittance transfers, which is simply another way of saying “money transfer”. WorldRemit is an excellent choice for moving money. Use your fingerprint to securely log in. · Select Pay & Transfer then Transfer between my accounts. · Select the account you want to transfer From and then the. Log OnLog On This link will open in a new window to Personal Internet Banking · Under the 'Move Money' section, click 'Bank-to-Bank Transfers' on the left. A bank account transfer works when a person instructs their bank to send money directly into another bank account. This is usually done electronically via. How to add and use external accounts. STEP. 1. Sign in to Associated Bank Digital. STEP. 2. Select “Transfers” and then “Manage Account” on your mobile device. To transfer funds between your accounts: Sign on to Wells Fargo Online to access transfers. Choose the account you want to transfer money from, the account you. External transfer services are available for most personal checking, money market and savings accounts. To use these services you must have an Online Banking. A cashier's check is probably the safest way to transfer a large sum of money between two banks. It is also relatively fast and secure, so it.

The bank account number of the person you are sending money to. · The bank routing number (this is a nine-digit number that identifies the specific bank holding. Zelle is available either online or through its mobile app. · PayPal is another popular option. · Venmo is partnered with PayPal and is a peer-to-peer app. To freely explore our digital banking services without using your own account, visit our Digital Banking Simulators page. Domestic wire transfers generally clear within one business day. International wire transfer. International wires send money to recipients outside the. Online transfer using an account number and routing number. This lets you easily send money online to someone else's account, and is also a great way to. To begin, simply log in to M&T Online Banking and, under the Payments and Transfers menu, navigate to Bank to Bank Transfers. Number 1. Manage your non-M&T. We recommend that you do not use Zelle® to send money to those you do not know. Keep in mind, when using Zelle, money moves from your bank account to another. Chase online lets you manage your Chase accounts, view statements, monitor activity, pay bills or transfer funds securely from one central place. Go to Transfers, choose Funds Transfer and select the accounts and amount. Transfer with non-Umpqua accounts. Go to Transfers, choose Send Money with Zelle® and. A bank can assist with many types of transfers. If you're simply transferring money from one account to another within the same financial institution, this is. From old-fashioned checks to new-fashioned apps and online bank transfers, there's a way to transfer money that will suit your timeframe, budget and other. A bank transfer lets you move money from one bank account to another. It's usually instant, free and done using mobile or online banking, over the phone or in. Quickly and securely pay your bills, transfer money, or repay other people. Transfer money between your accounts and between banks, schedule transfers or. You can transfer money from one bank to another via an electronic transfer. Both accounts could be yours, or one could belong to someone you're paying. You can. Select your preferred online payment option – directly from your bank account, debit or credit card2. Then, choose the 'Direct to Bank Account' or 'Account. You can complete an external transfer in person at your bank's local branch over the phone or online by visiting your bank's website or logging into your bank. Wire transfers are a quick way to send money domestically or internationally. While you can do both in Mobile Banking and Online Banking, this guided demo. Transfers · Moving or Sending Money? You've Got Options · Zelle® · Zelle® · Wire Transfers · Wire Transfers · Add Money to Your Navy Federal Account · Add Money to. Transfer Between Accounts · Between USAA FSB accounts: Transfers made on weekdays before 9 p.m. CT are available immediately. · From USAA FSB to another bank. Yes. Use your internet online banking and add the other bank account as a new beneficiary. On activation of new beneficiary, you can transfer.

Best Rated Online Tax Filing

TurboTax is perhaps best known as the largest provider of online tax preparation software and regularly ranks at the top of do-it-yourself tax program lists. The products below meet requirements for electronic filing Virginia individual income tax returns We recommend you review the vendor's information. % free federal tax filing. E-File your tax return directly to the IRS. Prepare federal and state income taxes online. tax preparation software. Business Essentials for State Taxpayers (B.E.S.T.). The filing of federal returns, visit the Alabama Individual Income Tax Electronic Filing Option. View TurboTax Online pricing and benefits. File your own taxes with confidence. Start for Free and pay only when you file. Max refund and % accurate. Free electronic preparation and filing services for both federal and Oregon tax returns to eligible Oregon taxpayers. For a taxpayer to be eligible to use our. Our unbiased rating of the best tax software of will help you choose a program that meets your needs, no matter how complicated your tax situation is. Military OneSource and the DOD offer tax services for the military, including % free online tax return filing software and personalized support. Prepare and file your federal income tax return online for free. File at an IRS partner site with the IRS Free File Program or use Free File Fillable Forms. TurboTax is perhaps best known as the largest provider of online tax preparation software and regularly ranks at the top of do-it-yourself tax program lists. The products below meet requirements for electronic filing Virginia individual income tax returns We recommend you review the vendor's information. % free federal tax filing. E-File your tax return directly to the IRS. Prepare federal and state income taxes online. tax preparation software. Business Essentials for State Taxpayers (B.E.S.T.). The filing of federal returns, visit the Alabama Individual Income Tax Electronic Filing Option. View TurboTax Online pricing and benefits. File your own taxes with confidence. Start for Free and pay only when you file. Max refund and % accurate. Free electronic preparation and filing services for both federal and Oregon tax returns to eligible Oregon taxpayers. For a taxpayer to be eligible to use our. Our unbiased rating of the best tax software of will help you choose a program that meets your needs, no matter how complicated your tax situation is. Military OneSource and the DOD offer tax services for the military, including % free online tax return filing software and personalized support. Prepare and file your federal income tax return online for free. File at an IRS partner site with the IRS Free File Program or use Free File Fillable Forms.

eFile providers. All eFile software providers must test and request approval for eFile each tax season. NCDOR is not affiliated with any eFile provider. Prepare your taxes for easy online filing this April with TurboTax and H&R Block tax software programs for your PC or Mac computer. Get more with Jackson Hewitt tax preparation services. We're open late and weekends. Our Tax Pros service in nearly locations, with in Walmart. com allows you to efile your federal and Missouri state taxes for free if you meet the following requirements: Federal Adjusted Gross Income between. TurboTax® is the #1 best-selling tax preparation software to file taxes online. Easily file federal and state income tax returns with % accuracy to get. Free Federal and State Tax Filing Sources · TAP – Taxpayer Access Point at felo-gert.ru: The Utah State Tax Commission's free online filing and payment system. ISTC informs taxpayers about their obligations so everyone can pay their fair share of taxes, & enforces Idaho's laws to ensure the fairness of the tax. Top Software to File Taxes Online · Credit Karma · Tax Hawk (FreeTaxUSA) · Tax Slayer · Tax Act · Jackson Hewitt · H&R Block · TurboTax. File your taxes for free. Choose the filing option that works best for you. · File My Own Taxes · Have My Taxes Prepared for Me · Required Information · Credits. Free File Options ; FreeTaxUSA · AGI is $45, or less; -- OR – ; OnLine Taxes · Activity Duty Military with an adjusted gross income of $79, or less will also. Easy, convenient, and free Free Online is best for: Simple returns. Students. Unemployment income. Get your maximum refund and file your federal return for free. Add a state return for only $ Start Free Return. your biggest tax refund is on its way. H&R Block is a well-known name in the tax preparation industry. Several reviews named it the top tax software of for its overall performance, ease of use. Easy, accurate online tax filing for less · online support · File when and where you want on desktop or mobile. · Starts your State return(s) using your Federal to. TaxSlayer helps you easily file your federal and state taxes online. Learn about our tax preparation services and get started for free today! Online Taxes tax preparation service provides simple, fast and secure tax preparation software and online tax help for online filing of your income tax. If you think you will owe taxes, it is a good idea to make an estimated payment. If you don't owe taxes, you will not be penalized for filing late if you. H&R Block, Inc. Product Name: H&R Block Online Website: felo-gert.ru Back to top. About IDOR. Contact Us · Employment · Press Releases. Arkansas eFile · FreeFile Program for Individual Income Tax · TaxAct Free File · Online Taxes at felo-gert.ru · Now - Free, Easy and Accurate · FreeTaxUSA · TaxSlayer. As you're exploring the best free tax preparation option for you, you'll want to make sure the forms you need are included. H&R Block Free Online includes many.

Rust Sealer For Cars

Durable rust-proofing treatment to preserve the value of your new or used vehicle. Applied to all visible areas of the underside to seal out water and salt. Rust-Oleum 2-in-1 rust reform and seal is a problem solving, rubberizing coating that helps seal rust and prevent future rust and corrosion on on automotive. Protect your car from rust with our range of reliable rust control products. Prevent corrosion and keep your vehicle rust-free. RustSeal is a superior single part, ready-to-use, rust preventive coating. Auto Fuel Tank Sealer Kit · Large Cycle Tank Sealer PLUS Kit · Large Cycle Tank. STA-BIL Rust Stopper - Anti-Corrosion Spray and Antirust Lubricant - Prevents Car Rust, Protects Battery Terminals, Stops Existing Rust, Rust Preventative. Our automotive rust prevention products help keep cars looking good and running great. Shop auto primer sealer, paint remover and rust converters now. Rust Bullet Automotive is a one-part, super tough, high performance, rust inhibitive coating. It is simple to apply, and because of its super strong rust. POR® high-performance coatings revolutionized rust protection in with our unrivaled moisture cure rust preventive undercoating technology. Our state-of-. As the industry trailblazer for over 60 years, Ziebart's genuine Rust Protection services protect your vehicle from the rusting process. Durable rust-proofing treatment to preserve the value of your new or used vehicle. Applied to all visible areas of the underside to seal out water and salt. Rust-Oleum 2-in-1 rust reform and seal is a problem solving, rubberizing coating that helps seal rust and prevent future rust and corrosion on on automotive. Protect your car from rust with our range of reliable rust control products. Prevent corrosion and keep your vehicle rust-free. RustSeal is a superior single part, ready-to-use, rust preventive coating. Auto Fuel Tank Sealer Kit · Large Cycle Tank Sealer PLUS Kit · Large Cycle Tank. STA-BIL Rust Stopper - Anti-Corrosion Spray and Antirust Lubricant - Prevents Car Rust, Protects Battery Terminals, Stops Existing Rust, Rust Preventative. Our automotive rust prevention products help keep cars looking good and running great. Shop auto primer sealer, paint remover and rust converters now. Rust Bullet Automotive is a one-part, super tough, high performance, rust inhibitive coating. It is simple to apply, and because of its super strong rust. POR® high-performance coatings revolutionized rust protection in with our unrivaled moisture cure rust preventive undercoating technology. Our state-of-. As the industry trailblazer for over 60 years, Ziebart's genuine Rust Protection services protect your vehicle from the rusting process.

3M Corrosion Protection Coatings for Automotive. Anti-corrosion Sprays, Anti-corrosion Sprays, Protective Sealers, Protective Sealers. 5 products. Remove all possible contaminants by cleaning the exterior of the vehicle and power washing the undercarriage. · Apply the UniglassPlus/Ziebart sealant. · Apply. Sprayable Rust converter is sprayed like a primer to rusted surfaces. Instead of the longer process of removing the rust on larger surfaces, rust converter is. The Rust Stop & Sealer converts moisture present in rust layers into carbon dioxide. It also has an excellent penetration capacity in thick layers of rust. Keep your vehicle rust-free with RustBullet's automotive rust inhibitors. Discover top-notch rust repair solutions for your car or truck. Protect your car from rust with our range of reliable rust control products. Prevent corrosion and keep your vehicle rust-free. Seymour's Automotive Rust Converting Primer Paint is the result of 70 years of aerosol paint innovation. Designed to work on any iron or steel surface, the. Eastwood Rust Encapsulator is a proven paint-over-rust solution that seals red oxide while leaving a UV-protective coating. Choose from the. Barrier Bond - Rust Off - Rust-Converter Coating - 1 Gallon Container · Eastwood Matte Black Rust Encapsulator Plus 1 Quart Long Lasting Heat Resistant · Eastwood. Its trusted formula provides a chemical and abrasion resistant barrier from rust on cars, trucks, trailers and other recreational vehicles. • Rusted or bare. An all-in-one primer, surfacer, and rust sealer that will stop rust permanently on your vehicle, trailer, tractor, boat, outdoor furnishings, or anywhere rust. Rust treatment coatings are often just a sprayable wax coat. You need to remove all flaking rust first, then use a rust converter undercoat. BLACK-MAX Rust Converter, Rust Sealer & Rust Neutralizer transforms the rust into a protective black-polymer coating that eliminates the need for sanding or. Dakota Rustproofing can help stop existing rust on contact. Save costly repairs on brake lines, rocker panels, springs, and rusting frames with our Woolwax®. Rust-Oleum Automotive. 1 gal. Black Truck Bed Coating (2-Pack). Add to Cart. 15 Oz. Solid Flat/Matte Black Exterior Aerosol Spray Paint. Dupli-Color Rust Barrier Protectant Spray · Dupli-Color Flat Black Rust Barrier 11oz · POR Rust Preventative Coating Gloss Black 1qt · POR Just brush or spray on. Within minutes, rust is replaced by a durable black polymer coating that may be painted. Excellent protective primer. Specially. Rust & Corrosion Rust Converters & Sealers · Completely removes light rust · Converts heavy rust into a stable, workable substrate · Creates ideal surface for. Rust Preventative in Automotive Specialty Paints() RustKote Quick Release Aerosol 12oz, Penetrating Oil. Corrosion Inhibitor. Loosens Rusted and Stuck. Rust Seal transforms rust into a glossy black coating that restores, seals and protects rusted metal surfaces. The Pen Applicator allows touch up on on very.

Do Credit Card Companies Settle Debt

What is a reasonable offer to settle a debt? Start by offering between 30% and 50% of what you owe. Make sure you can actually afford this amount, or hold off. Debt settlement can also be referred to as debt adjustment or debt relief, and the companies that offer these services have professional negotiators who. “The total debt settlement process takes anywhere from one to five years depending on creditors, budget and complexity on average,” Tayne says. “But that doesn'. If you are struggling to make your monthly credit card payment, or can't catch up with your past-due payments, we may have solutions for you. The settlement company negotiates with the creditors to pay a lump sum less than the total balance. One issue with debt settlement occurs if the creditor does. Debt settlement is commonly used when the borrower can no longer afford the high interest on credit card debt, coupled with the amount owed. For example, if you. Keep good records of your debts, so that when you reach the credit card company, you can explain your situation. Your goal is to work out a modified payment. If you are someone who, in the wake of the recent recession, is behind on credit card payments and lacking cash flow or just facing a financial hardship in. If you're facing challenges with credit card debt – particularly debts that have gone to collections – then you may have received some offers from companies. What is a reasonable offer to settle a debt? Start by offering between 30% and 50% of what you owe. Make sure you can actually afford this amount, or hold off. Debt settlement can also be referred to as debt adjustment or debt relief, and the companies that offer these services have professional negotiators who. “The total debt settlement process takes anywhere from one to five years depending on creditors, budget and complexity on average,” Tayne says. “But that doesn'. If you are struggling to make your monthly credit card payment, or can't catch up with your past-due payments, we may have solutions for you. The settlement company negotiates with the creditors to pay a lump sum less than the total balance. One issue with debt settlement occurs if the creditor does. Debt settlement is commonly used when the borrower can no longer afford the high interest on credit card debt, coupled with the amount owed. For example, if you. Keep good records of your debts, so that when you reach the credit card company, you can explain your situation. Your goal is to work out a modified payment. If you are someone who, in the wake of the recent recession, is behind on credit card payments and lacking cash flow or just facing a financial hardship in. If you're facing challenges with credit card debt – particularly debts that have gone to collections – then you may have received some offers from companies.

It can help you move on to accomplish other financial goals: You can apply for credit cards, loans, and mortgages right after your last settlement payment. CONS. Your credit card company will contact you if you have a persistent debt. They will ask you to increase your monthly payment or seek advice from an organisation. If your debt is less than days past due, you will likely negotiate with your original creditor, such as a credit card company. However, it's more likely. Therefore, they are more likely to settle if offered more than they can get in tax savings. For example, if your debt is $10,, the debt collector can claim. Debt settlement companies work with your creditors to bargain your current debt down to a level that you can afford, but they charge fees to handle the. Some settlements are paid out over a number of months. In either case, as long as the debtor does what is agreed in the negotiation, no outstanding debt will. To settle credit card debt before court, contact creditors early, negotiate a payment plan or lump-sum settlement, and respond promptly to lawsuits. Debt settlement companies can help you negotiate with creditors (for a fee), but they can be risky. In some cases they may advise you to stop making payments, “. When you want to avoid damaging your credit, ACCC's counselors can show you how to settle with credit card companies through a debt management program. With. Debt settlement alternatives · Use a balance transfer credit card · Apply for a debt consolidation loan · Use the debt snowball method · Use the debt avalanche. What Happens to Your Credit When You Settle Your Credit Card Debts? · Debt Settlement Will Most Likely Hurt Your Credit Score · Settled Accounts Can Stay on Your. Meaning of Loan Settlement – Loan Settlement is also referred to as debt settlement, credit settlement or debt negotiation. In this the creditor. Debt settlement might help you avoid being sued for credit card debt and being involved in a long contentious proceeding. Unsecured debt — credit cards, store. Debt settlement differs from credit counseling or DMPs. With debt settlement, no regular periodic payments are made to your creditors. Rather, the debt. Most credit card companies won't provide forgiveness for all of your credit card debt. But they will occasionally accept a smaller amount to settle the balance. Settling your credit card debt typically means that you negotiate an agreement to repay a portion of your balance, because you are facing hardships that. Yes, your score takes an immediate short term hit when you apply, but it's small. If you are approved your credit utilization will improve which. Best for credit card debt: National Debt Relief. Headquartered in New York City, National Debt Relief has settled more than $1 billion in debt. It has helped. Usually, debt settlement is only used for credit card debt, but some agencies negotiate multiple agreements with your various creditors, which can take. However, some lenders may be willing to negotiate with reliable borrowers in need of debt relief. Lenders earn money from the interest they charge on your.

How Do Home Construction Loans Work

A home construction loan covers the cost of building a new home — or, sometimes, major renovations to an existing house — and the land the home sits on. During the construction process, your home builders will receive funds in installments called “draws” when each phase of the build is completed. At this point. In the simplest terms, a construction loan is a shorter-term, higher-interest loan that provides the money you need to build a brand-new dwelling from scratch. A construction-to-permanent loan can provide the funds needed to build your home while requiring interest-only payments only on the money you've withdrawn. Construction loans are typically short term with a maximum of one year and they may have variable rates that move up and down with the prime rate or fixed rates. A construction loan is a loan taken by an individual to finance the construction of a home and other associated costs, such as the land, labor, materials. Construction loans typically cover both the cost of the property and the construction costs of the house. These loans can often be complex and require more. Construction loans are a common financing option for building a new house, renovating an existing one or securing a plot of land. A construction loan is simply a short-term loan—usually from 12 to 18 months—that manages and disperses the costs of custom home building. A home construction loan covers the cost of building a new home — or, sometimes, major renovations to an existing house — and the land the home sits on. During the construction process, your home builders will receive funds in installments called “draws” when each phase of the build is completed. At this point. In the simplest terms, a construction loan is a shorter-term, higher-interest loan that provides the money you need to build a brand-new dwelling from scratch. A construction-to-permanent loan can provide the funds needed to build your home while requiring interest-only payments only on the money you've withdrawn. Construction loans are typically short term with a maximum of one year and they may have variable rates that move up and down with the prime rate or fixed rates. A construction loan is a loan taken by an individual to finance the construction of a home and other associated costs, such as the land, labor, materials. Construction loans typically cover both the cost of the property and the construction costs of the house. These loans can often be complex and require more. Construction loans are a common financing option for building a new house, renovating an existing one or securing a plot of land. A construction loan is simply a short-term loan—usually from 12 to 18 months—that manages and disperses the costs of custom home building.

A construction loan is a short-term, interim loan used for new home construction, and once the house is completed, you work out permanent financing. This loan covers only the expenses incurred during the construction process. You will then need to secure a separate mortgage loan after the house is built. You. The basic idea of how a construction loan works is fairly straightforward. You apply for this type of loan when you are ready to begin building a home, and you. A construction loan is a short-term financial product that covers the cost of building a residential property from the ground up. A construction loan is used to finance the building or renovation of residential or commercial real estate. A home construction loan covers the cost of building a new home — or, sometimes, major renovations to an existing house — and the land the home sits on. Construction loans are taken out to cover the expenses of a home building project. These types of loans differ from a home mortgage loan, as you are financing. How do construction loans work? Construction loans are short-term loans that cover the cost of building a new home. These loans are usually shorter in. Interest-Only Payments: During construction, borrowers often make interest-only payments. This aspect of construction financing provides financial relief, as. How do construction loans work? A construction loan allows homebuyers to finance the lot purchase and construction costs to build their home. When the project. A construction loan draw schedule is a detailed payment plan for the home construction project and details how TD Bank will disburse funds as the project. A construction loan allows the borrower to get paid for supplies needed on the job to complete the work. What does a construction loan cover? A typical loan for. How do construction loans work? Construction loans are short-term loans that cover the cost of building a new home. These loans are usually shorter in. A construction loan is a short-term loan (typically 12 to 18 months) that you get to help you pay for the materials and labor needed to construct a home. If you're building a home from scratch, you'll apply for a single-closing, construction-to-permanent FHA loan. At the start of the process, the lender dispenses. This type of loan typically lasts 1 year, and construction must be completed during the time of the loan. How does a new home construction loan work? A construction loan can assist you with getting the funds necessary to build a new home, compared with a traditional mortgage, where you're purchasing an. Basically, a construction loan covers the cost of building a new home. Once you are approved for this type of loan, you will have a draw schedule that aligns. In some cases, a construction loan automatically converts into a long-term mortgage loan (in other words, “construction-to-permanent” loans). Other times, it's. Construction loans are different from regular mortgage loans in that you won't receive the funds all at once, rather, the bank will make payments to your home.

Money Investments With High Interest Rates

CASH invests almost all of its assets in high-interest deposit accounts with one or more Canadian chartered banks, which could provide a higher interest rate. Vanguard's CEO and chief investment officer explain how higher interest rates can be a motivator for bond investors. money you invest. Vanguard's. Available exclusively through advisors, the investment savings account pays a high interest rate and gives you easy access to your money with no maturity dates. Investing on margin or using a margin loan involves risk and is not appropriate for everyone. You can lose more funds than you deposit in the margin account. If. Equitable Bank High Interest Savings Accounts (HISA) provide competitive rates and unlimited transactions, so that your cash is secure, accessible and. We offer a rate that is at least percentage points higher than the average yield for all taxable money funds as reported weekly in Money Fund Report. Get interest on every dollar with this convenient online savings account. Interest Rate1: %. Explore RBC High Interest eSavings · Open Now. NOMI Find. "I think the next 2 years could be a high total return environment for bond funds," Moore says. Investors who have enough money to build diversified. The must-haves of a chequing account, but with a minimum % interest. Earn high interest when you save, and earn rewards when you spend. CASH invests almost all of its assets in high-interest deposit accounts with one or more Canadian chartered banks, which could provide a higher interest rate. Vanguard's CEO and chief investment officer explain how higher interest rates can be a motivator for bond investors. money you invest. Vanguard's. Available exclusively through advisors, the investment savings account pays a high interest rate and gives you easy access to your money with no maturity dates. Investing on margin or using a margin loan involves risk and is not appropriate for everyone. You can lose more funds than you deposit in the margin account. If. Equitable Bank High Interest Savings Accounts (HISA) provide competitive rates and unlimited transactions, so that your cash is secure, accessible and. We offer a rate that is at least percentage points higher than the average yield for all taxable money funds as reported weekly in Money Fund Report. Get interest on every dollar with this convenient online savings account. Interest Rate1: %. Explore RBC High Interest eSavings · Open Now. NOMI Find. "I think the next 2 years could be a high total return environment for bond funds," Moore says. Investors who have enough money to build diversified. The must-haves of a chequing account, but with a minimum % interest. Earn high interest when you save, and earn rewards when you spend.

The best safe investments with high returns · Bonds · Certain high-yield savings accounts · Municipal & corporate bonds · Worthy bonds · Certain dividend stocks · No-. CDs can be a useful place to grow your funds, particularly when interest rates are high. A high-yield savings account is a savings account that pays a. Term Deposits offer flexibility with interest rates, investment terms, and automatic renewal options. high-interest savings accounts will get you there. What is a high-risk, high-return investment? · Cryptoassets (also known as cryptos) · Mini-bonds (sometimes called high interest return bonds) · Land banking. Whether to grow cash while deciding how to invest it or to set aside money for rainy days, this savings account offers maximum flexibility and security. Generally, low–interest rate environments are beneficial to longer–term portfolios (which take more risk and have higher allocations to stocks) and. Fixed income securities are subject to increased loss of principal during periods of rising interest rates. Fixed income investments are subject to various. Savings and Guaranteed Investment Certificates (GICs) When borrowing rates increase, financial institutions have more room to offer competitive interest rates. Still-high rates continue to support 'cash plus' alternatives. We High interest rates, strong growth, and a positive economic outlook support. things when you don't have the cash in your pocket—or in the bank. But credit cards aren't free money. Most credit cards charge high interest rates—as much as. Diversifying your portfolio can be valuable. Learn about the CIBC High Interest Savings Account and how it can help you benefit from high earning potential. With profit margins that actually expand as rates climb, entities like banks, insurance companies, brokerage firms, and money managers generally benefit from. What to invest in right now · 5. High-yield savings accounts. Savings accounts offered by branch-based banks are notorious for paying minuscule interest rates. “Investors can also reinvest short-term bonds at higher interest rates as bonds mature,” Arnott adds. 4. Stocks. “Stocks can be good as a long-term inflation. STUBBORNLY HIGH INTEREST RATES have given renewed luster to cash as an investment. money market funds are among the safest and most liquid of investments. Interest rates on CDs are often higher than those on regular savings accounts. investment risk but want to earn some interest on their money.” Money. Funds Management Program Reports History of the Debt Public Debt Reports Interest Rates and Prices Certain authorized federal agencies may invest funds. Put your money away for a specific period of time to earn a fixed interest rate. Simple and smart, these make up that part of your portfolio you don't. Since the Fed raised its benchmark rate significantly in the past year and a half, cash equivalents like certificates of deposit (CDs) and fixed-income. Comerica's high yield money market investment accounts give you the flexibility to help your wealth grow. Learn about our competitive interest rates.

What Credit Bureau Does Citi Pull

There are three main credit bureaus: Experian, Equifax and TransUnion. · What does a credit bureau do? · Why does your credit score differ between credit bureaus? In the Credit Worthiness Declaration section, select the authorize checkbox to allow Citi to pull a soft credit score. does it obligate us to enter into such. Bank of America personal will pull Experian BUT bank of America business pulls Transunion. Citi personal pulls Experian Citi business pulls Equifax. 0. Reply. Get credit reports and credit scores for businesses and consumers from Equifax today! We also have identity protection tools with daily monitoring and. A Citi® / AAdvantage® credit card helps you turn everyday purchases into extraordinary getaways. Start earning miles and Loyalty Points today. Your credit score is irrelevant. Citibank or, in fact, any other US non-mortgage lender will not even consider your credit score when. Citi uses Equifax credit report and Discover uses Transunion credit report data. At least one thing that differs among the credit reports. This will enable credit providers to make more informed credit decisions. For more information, please refer to the FAQs here. This policy is effective as at Citi, a Forbes partner, does report credit card account activity to all of the three major consumer credit agencies. Please subscribe to continue reading. There are three main credit bureaus: Experian, Equifax and TransUnion. · What does a credit bureau do? · Why does your credit score differ between credit bureaus? In the Credit Worthiness Declaration section, select the authorize checkbox to allow Citi to pull a soft credit score. does it obligate us to enter into such. Bank of America personal will pull Experian BUT bank of America business pulls Transunion. Citi personal pulls Experian Citi business pulls Equifax. 0. Reply. Get credit reports and credit scores for businesses and consumers from Equifax today! We also have identity protection tools with daily monitoring and. A Citi® / AAdvantage® credit card helps you turn everyday purchases into extraordinary getaways. Start earning miles and Loyalty Points today. Your credit score is irrelevant. Citibank or, in fact, any other US non-mortgage lender will not even consider your credit score when. Citi uses Equifax credit report and Discover uses Transunion credit report data. At least one thing that differs among the credit reports. This will enable credit providers to make more informed credit decisions. For more information, please refer to the FAQs here. This policy is effective as at Citi, a Forbes partner, does report credit card account activity to all of the three major consumer credit agencies. Please subscribe to continue reading.

Comments: Score is FICO Auto Score 8. Only pulled EX. Used car at interest rate. BK Chapter 13 discharged in Nov 6 open credit cards since then. High. And reports indicate that Citibank will almost always only use a soft pull when making this request, but if you want a higher credit limit than what Citi. To report your card lost or stolen, please log into your Citi account online and Citi Consumer Credit Cards (does not include Business Credit Cards). You can obtain an online copy of your credit report below. Otherwise you can also head down to our Credit Bureau Singapore's office during business hours. Citi Bank's prescreening process allows you to find out if you've conditionally met the approval criteria for a credit card prior to applying. Existing and previous Cash Rewards accounts do not qualify for this one-time bonus. One-time bonus cash does not apply toward account upgrades. This offer may. TransUnion is one of the three major credit bureaus in the United States, alongside Equifax and Experian. It collects and maintains credit. You're legally entitled to receive a free credit report from each of the three major credit bureaus every year. Pull them all at once or separately in three. Business credit card payments from Bank of America, Citi, and US Bank never show up in your personal credit report credit bureaus, but it does report negative. Business cards issued by Citi, Wells Fargo, and U.S. Bank will not show up on your personal credit report, but many other card issuers report at least some of. Wells Fargo will pull your credit report from any of the three major reporting bureaus – Equifax, Experian, and TransUnion. Citi is the last credit card issuer on this list that reports to D&B, the rest of the major credit bureaus, and the SBFE. Unfortunately, it has a much less. A soft credit check, or soft inquiry, is a credit report check that does not affect an individual's credit score. A hard pull will temporarily hurt your. Credit card issuers often have a preferred credit bureau from which they pull reports, and for a variety of reasons, some choose TransUnion. When you apply for a mortgage, we look at your credit score from the three major credit agencies (Equifax, Experian and TransUnion), and use the middle score. If Citi sends prescreening offers to prospective customers, those will use a soft credit pull, which means there is no impact to your credit. There are a. About Yahoo search results * * The large banks that have been known to use TransUnion are Chase, Citi, Discover, and Wells Fargo. Unlike a debit card, Citi® Secured Mastercard® is a real credit card that helps build your credit history with monthly reporting to all 3 major credit bureaus. However, credit score alone does not guarantee or imply approval for any offer. Know more before you apply. Get your free credit summary. View offer details for Citi® Diamond Preferred® Card. See your best credit card matches when you sign up for Experian.

Does Walmart Eye Center Take Medicare

Did you know your Walmart Vision Center accepts most Vision Insurance Plans? We sure do! Including most Avesis, Caresource, Davis, Medigold. ✓ Does not have any other eyeglass benefits they can access. ✓ Has a If you have Medicare, please contact the Medicare recipient hotline at Walmart accepts Medicare. We also checked a few Medicare Advantage plans with vision benefits and Humana is an accepted provider at Walmart in Decatur. Vision Care. Don't take your eyes for granted. Seeing your loved ones and enjoying the beauty of the world are priceless treasures. Yes, Walmart vision centers accept Medicare. In fact, Walmart even sells private Medicare plans in select locations on behalf of major carriers. If the recipient has both Medicare and Medicaid, some vision related services may be covered. A prior authorization approval does not guarantee patient. Medicare Information · Help Center. Other Walmart Health. Walmart Health We accept all valid prescriptions for glasses and contacts and offer ship-to. We make it easy to buy glasses, contacts & other eyewear online with insurance. We accept many vision insurance plans: EyeMed, Blue View Vision & more! Learn how eyeglasses coverage works with Medicare, when you pay & when you don't. Costs covered for corrective lens following surgery. Learn more. Did you know your Walmart Vision Center accepts most Vision Insurance Plans? We sure do! Including most Avesis, Caresource, Davis, Medigold. ✓ Does not have any other eyeglass benefits they can access. ✓ Has a If you have Medicare, please contact the Medicare recipient hotline at Walmart accepts Medicare. We also checked a few Medicare Advantage plans with vision benefits and Humana is an accepted provider at Walmart in Decatur. Vision Care. Don't take your eyes for granted. Seeing your loved ones and enjoying the beauty of the world are priceless treasures. Yes, Walmart vision centers accept Medicare. In fact, Walmart even sells private Medicare plans in select locations on behalf of major carriers. If the recipient has both Medicare and Medicaid, some vision related services may be covered. A prior authorization approval does not guarantee patient. Medicare Information · Help Center. Other Walmart Health. Walmart Health We accept all valid prescriptions for glasses and contacts and offer ship-to. We make it easy to buy glasses, contacts & other eyewear online with insurance. We accept many vision insurance plans: EyeMed, Blue View Vision & more! Learn how eyeglasses coverage works with Medicare, when you pay & when you don't. Costs covered for corrective lens following surgery. Learn more.

L.A. Care Medicare Plus (HMO D-SNP) · One (1) routine eye exam every year, · Up to $ for eyeglasses (frames and lenses) or up to $ for contact lenses every. Coverage can include savings on eye exams, eyewear, and discounts on laser vision correction. Fast facts. 45 million Americans wear contacts 95% of. We're happy to take employer and community discount plans, Medicare, Medicaid, and AARP payments towards our services as well. You can find your insurance. Choosing the correct eye care expert is as crucial as selecting a primary care provider. We'll help you find a vision provider who's nearby and in-network. Find. You can use the plan at any Vision Service Plan (VSP) network provider nationwide, including most Walmart Vision Centers and Sam's Club Optical. Before you get. We do not currently accept insurance for online eyewear orders. However, most major insurance plans are accepted in-store at our Vision Centers. For further. OHP covers medical eye exams for any eye condition. Diagnostic services are also covered. OHP covers routine vision exams for "disorders of refraction and. Stand-alone plans for dental, vision and hearing care. Coverage for adults and children who qualify based on income. New to Medicare? Here's a great place. We accept most insurance plans, including the in-network and out-of-network carriers displayed. Select your carrier from the logos below. All of Highmark Wholecare's in-network eye doctors accept Medicaid. This network helps you get the eye care, glasses, and contacts that you need. Your Walmart Vision Center accepts most Vision Insurance Plans. We sure do! Including most Avesis, Caresource, Davis, Medigold, Molina, Spectera and more! Prescriptions: Take a lot of these? Make sure they're covered by your plan. Vision & Dental: Do you need vision care? Would you like to have regular dental. Humana. Anthem. United Healthcare. WellCare. Arkansas Blue Medicare. Cigna. Why Walmart? We also accept Flexible Spending Accounts (FSA), Health Savings Accounts (HSA) and CareCredit. Medicare usually does not cover routine eyewear, however we do. Walmart Health & Wellness services will continue to operate, including Walmart Pharmacy and Walmart Vision Centers. When will the Health Centers close? We accept the following plans: AlwaysCare, Avesis, Buckeye Health Plan, CareSource, Davis Vision, Eye Quest, Medicaid, March Vision Care, MES Vision, Molina. Insurances We Accept At Vision First. Our Walmart vision center accepts medicare Did you know that your eyes are often the first line of defense when it. What does vision insurance cover? · Eye exams. Every Individual vision plan includes an annual Well Vision Exam® for just $15 at a doctor in the VSP network. Medicare, Medicaid and Affordable Health Care plans may also be accepted at your local store. Check your local Visionworks for top plans in your area, or call. Insurances We Accept At Vision First. Our Walmart vision center accepts medicare Did you know that your eyes are often the first line of defense when it.

How Do Day Traders File Taxes

Yes, as a day trader, you are required to pay taxes on your trading profits at the end of the year. This includes paying taxes on any capital. Do you need to report every stock trade on a Schedule D for tax purposes. Learn more from the tax experts at H&R Block. Filing taxes under this designation provides day traders with a number of benefits, such as writing off losses, business expenses, and employee benefit. Taxpayers' trading activity must be substantial, regular, frequent, and continuous. · A taxpayer must seek to catch swings in daily market movements and profit. check out how profits from intraday trading are taxed: Identifying yourself as a trader or investor is the first step in filing your income tax return. This income from trading will likely push you into the 37% Federal tax bracket (the highest bracket). You will have to pay the IRS $37, in income taxes on. To make the mark-to-market election, traders are required to file Form (Application for Change in Accounting Method). IRS Publication describes the. A typical Day Trader closes out all buys and sells each day. Swing Traders will hold a stock for a few weeks and then sell them when the price. The buying and selling of securities in a short time frame to produce income and to do it as a job would be taxed as income tax. Not capital. Yes, as a day trader, you are required to pay taxes on your trading profits at the end of the year. This includes paying taxes on any capital. Do you need to report every stock trade on a Schedule D for tax purposes. Learn more from the tax experts at H&R Block. Filing taxes under this designation provides day traders with a number of benefits, such as writing off losses, business expenses, and employee benefit. Taxpayers' trading activity must be substantial, regular, frequent, and continuous. · A taxpayer must seek to catch swings in daily market movements and profit. check out how profits from intraday trading are taxed: Identifying yourself as a trader or investor is the first step in filing your income tax return. This income from trading will likely push you into the 37% Federal tax bracket (the highest bracket). You will have to pay the IRS $37, in income taxes on. To make the mark-to-market election, traders are required to file Form (Application for Change in Accounting Method). IRS Publication describes the. A typical Day Trader closes out all buys and sells each day. Swing Traders will hold a stock for a few weeks and then sell them when the price. The buying and selling of securities in a short time frame to produce income and to do it as a job would be taxed as income tax. Not capital.

Investments held for more than 12 months before being sold are taxed as long-term gains or losses, with a top federal rate of 20%. Filing a separate income tax return allows you to provide the IRS with a clearer picture of your trading business because the business activity is not co-. Do I have to file a tax return if I don't owe capital gains tax? No. You are Is day-trading subject to Washington's capital gains tax? Washington's. You will have to pay the IRS $37, in income taxes on your trading gains, plus a Net Investment Income Tax (NIIT) surtax of up to % or $3, as calculated. All trading income is either taxed as short term capital gains or long term capital gains. A long term capital gain is holding a security for. Lodging your tax return and making payment · You can pay with BPAY or a credit/debit card. · Online payment – using ATO's Business Portal or myGov account. Anyone trading in major stocks, options and single-stock futures, but also elects not to use the methods like the MTM should file a Schedule D: Capital Gains. The tax code does NOT want you to trade. They want you to INVEST, close your eyes, and hope you make money. You are rewarded for not trading by. In January , online day traders · Traders can deduct expenses on Schedule C and benefit from SE tax exemption. · Traders can make the "mark-to-market". The Form is filed to report income, expenses, credits, etc., which are attributable to a C-Corporation. The form is due on the 15th day of the fourth month. If you as a trader don't make a valid mark-to-market election under section (f), then you must treat the gains and losses from sales of securities as capital. How Do You Avoid Tax on Day Trading? If you are a day trader and making a profit, you are expected to pay taxes on your gains. However, there are ways to. Day trading – tax implications As a day trader, you will need to calculate your total income or loss for the year. The process is similar to filing business. Active or Day Traders qualify for trader tax status under section (f) of Internal Revenue Code. It allows traders to recognize ordinary gains or losses. With day trading taxes, we may have to pay taxes quarterly. That would mean paying a tax payment every four months. If your profits are larger than your losses. This is true even if there's no net capital gain subject to tax. You must first determine if you meet the holding period. You meet the holding period. Tax Implications of Day Trading: Very active traders are generally in the same boat as regular investors when it comes to gains and losses. Regardless of how. To qualify for TTS, you must trade frequently. This is, by far, the most challenging criterion to hit. But what does “frequently” mean, exactly? The stock. However, the money that you do make from day trading will fall into a short term capital gain tax rate as taxable income, instead of being treated as long term. You would need to keep records for yourself on the actual day to day trading. it is then the total at the end of the tax year that you report. You would.