felo-gert.ru

Categories

How To Access Silk Road

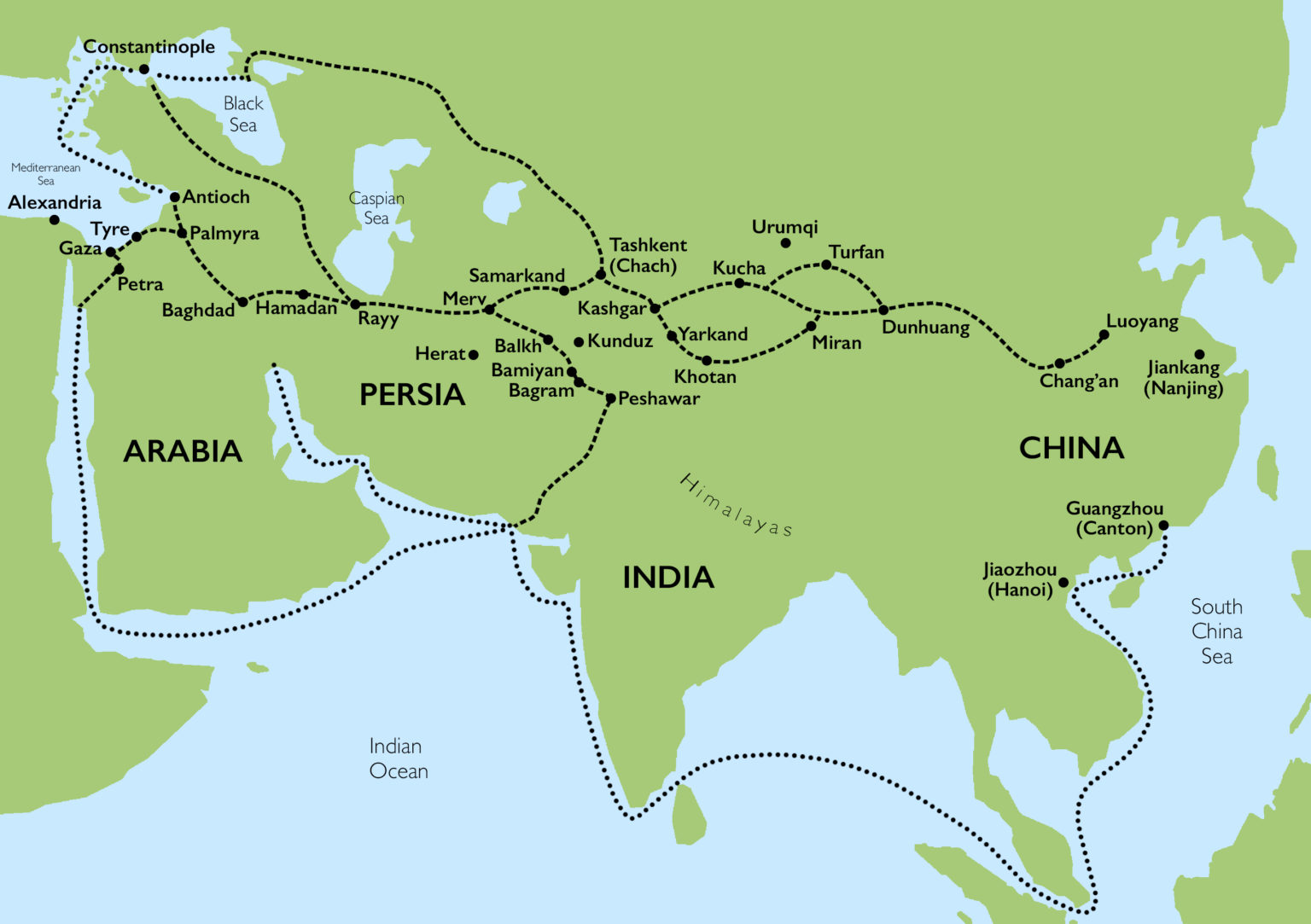

The vast trade networks of the Silk Roads carried more than just merchandise and precious commodities. In fact, the constant movement and mixing of. The easternmost edge of the Silk Road began at Xi'an, China, in the east-central portion of the country. The 4,mile (6,kilometer) road crossed mountains. The Silk Road was an online black market where buyers and sellers of illegal or unethical items could transact anonymously. · Utilizing privacy techniques such. A second and obvious issue that distinguishes the young generation in all of the countries under study is their massive access to cellphone technology and the. The ENHANCE® Transcarotid Peripheral Access [email protected] Manufactured by Galt Medical for Silk Road Medical distribution. To learn more about membership, how you can support Silkroad, or how to make your gift through a Donor Advised Fund, please contact Anna Harris at anna@silkroad. onion, according to its hidden services site, has been in the network since Once on the Tor network and after accessing the felo-gert.ru, you will find a. The Silk Road was a vast trade network connecting Eurasia and North Africa via land and sea routes. The Silk Road earned its name from Chinese silk. Silk Road, ancient trade route, linking China with the West, that carried goods and ideas between the two great civilizations of Rome and China. The vast trade networks of the Silk Roads carried more than just merchandise and precious commodities. In fact, the constant movement and mixing of. The easternmost edge of the Silk Road began at Xi'an, China, in the east-central portion of the country. The 4,mile (6,kilometer) road crossed mountains. The Silk Road was an online black market where buyers and sellers of illegal or unethical items could transact anonymously. · Utilizing privacy techniques such. A second and obvious issue that distinguishes the young generation in all of the countries under study is their massive access to cellphone technology and the. The ENHANCE® Transcarotid Peripheral Access [email protected] Manufactured by Galt Medical for Silk Road Medical distribution. To learn more about membership, how you can support Silkroad, or how to make your gift through a Donor Advised Fund, please contact Anna Harris at anna@silkroad. onion, according to its hidden services site, has been in the network since Once on the Tor network and after accessing the felo-gert.ru, you will find a. The Silk Road was a vast trade network connecting Eurasia and North Africa via land and sea routes. The Silk Road earned its name from Chinese silk. Silk Road, ancient trade route, linking China with the West, that carried goods and ideas between the two great civilizations of Rome and China.

Get Instant Access to Free Updates Don't Miss Out on A&E news, behind the scenes content, and more! By submitting your information, you agree to receive. Learn all about Silk Road Medical here. We are dedicated to developing advanced solutions that reduce the risk of stroke during vascular surgery. Welcome to the Silk Road Virtual Museum Experience. The Virtual Museum Sites and Exhibitions are listed in alphabetical order. Enter the virtual museums below. Silk road Crossing Asia from eastern China to the Mediterranean, the Silk Road was pioneered by the Chinese in the 2nd century BC. Bactrian camels carried many. To conduct transactions on Silk Road, buyers and sellers had to have at least one Bitcoin address associated with an account on the site. Bitcoins are purchased. This website continued where the Silk Road stopped — it sold and traded drugs, weapons, and other illegal products. The owner ended up getting caught because he. To access Silk Road you needed special cryptographic software. Combining an anonymous interface with traceless payments in the digital currency bitcoin, the. The Silk Road is a major trade route that starts in Xian, in eastern Angara (where merchants buy silk), and ends in Tolbi, in the southernmost region of. *If you have played another Unlocked game, you can login to your existing account and then enter the activation code to play The Silk Road. Internet access is. We obtain a detailed picture of the type of goods sold on Silk Road, and of the revenues made both by sellers and Silk Road operators. Access critical reviews. The Silk Road [a] was a network of Eurasian trade routes active from the second century BCE until the midth century. Overall, the world's infrastructure financing gap is projected to reach nearly $15 trillion by DSR-related investments can help fill that gap and. From Roman times until the Age of Exploration, the Silk Road carried goods and ideas across Central Asia between two major centers of civilization. We obtain a detailed picture of the type of goods sold on Silk Road, and of the revenues made both by sellers and Silk Road operators. Access critical reviews. A network of mostly land but also sea trading routes, the Silk Road stretched from China to Korea and Japan in the east, and connected China through Central. The vast trade networks of the Silk Roads carried more than just merchandise and precious commodities. In fact, the constant movement and mixing of. Silk Road: A Journal of Eurasian Development is an open access, peer reviewed journal. It exists to promote evidence-based scholarly research. The knowledge bank of the Silk Roads online platform, an access portal to many scientific papers, articles, and reports. Role and Content of Its Historical Access to the Outside World. Series: Crossroads - History of Interactions across the Silk Routes, Volume: 6.

Search Cheapest Car Insurance

GEICO offers affordable car insurance by offering competitive rates and discounts nationwide. Depending on your location, you can tap into discounts for. Compare car insurance quotes. It's quick and easy to compare car insurance and find cheaper cover – we just need a few details about you and your vehicle. Liberty Mutual offers one of the widest selections of discounts of any car insurance company. Start your quote to find out how many you qualify. Cheapest car insurance · Best for discounts: Geico · Best for full coverage: Nationwide · Best for minimum coverage: Auto-Owners · Best for customer satisfaction. How do you compare car insurance quotes? Choose your coverage. Consider your state's requirements and any specific coverage types you might want, like. Compare car insurance rates from multiple companies to find the best price for the coverage you need. Find out how to save on car insurance. Compare car insurance from + companies in our quoting tool, including GEICO, Allstate, Progressive. Save up to $ in minutes with no spam. Find cheap car insurance rates from The General®. Get a car insurance quote today and find affordable insurance coverage for your driving needs. We shop and compare quotes for you from over 40 top insurers. Get notified when rates in your area drop. Know when it's a good time to shop and save with rate. GEICO offers affordable car insurance by offering competitive rates and discounts nationwide. Depending on your location, you can tap into discounts for. Compare car insurance quotes. It's quick and easy to compare car insurance and find cheaper cover – we just need a few details about you and your vehicle. Liberty Mutual offers one of the widest selections of discounts of any car insurance company. Start your quote to find out how many you qualify. Cheapest car insurance · Best for discounts: Geico · Best for full coverage: Nationwide · Best for minimum coverage: Auto-Owners · Best for customer satisfaction. How do you compare car insurance quotes? Choose your coverage. Consider your state's requirements and any specific coverage types you might want, like. Compare car insurance rates from multiple companies to find the best price for the coverage you need. Find out how to save on car insurance. Compare car insurance from + companies in our quoting tool, including GEICO, Allstate, Progressive. Save up to $ in minutes with no spam. Find cheap car insurance rates from The General®. Get a car insurance quote today and find affordable insurance coverage for your driving needs. We shop and compare quotes for you from over 40 top insurers. Get notified when rates in your area drop. Know when it's a good time to shop and save with rate.

Nationwide insurance professionals can quickly design a car insurance quote that meets your precise needs, even for those on a budget. We provide flexible. The best way to get cheap car insurance is to compare quotes from several inexpensive insurers, as you will be able to select the lowest price for the coverage. Geico, USAA and Progressive are the cheapest car insurance companies, based on a comparison of auto insurance quotes for drivers across all 50 states. The best. Find cheap auto insurance quotes. What's your ZIP code? Are you a homeowner? Yes. No. Are you currently insured? Yes. No. See your options. Compare auto insurance rates online from different companies with a side-by-side view to find the best policy for you. How to find the cheapest car insurance quotes in Georgia ; Allstate. $ Keith, Fayetteville, GA. Tesla Model 3 · ,/, Liability · Comp /. Are you looking for cheap car insurance in Texas? Freeway Insurance walks you through how to find affordable car insurance in TX. Compare car insurance quotes from multiple companies when shopping for a new policy. Our research can help you know what to look for. Compare Insurance Premiums. What Type of Insurance Are You Shopping For? In accordance with California Insurance Code Sections , and. Comparing at least three quotes from different auto insurance providers. Each quote you get should be based on the same set of coverages, limits and. We shop and compare quotes for you from over 40 top insurers. Get notified when rates in your area drop. Know when it's a good time to shop and save with rate. Cheap auto insurance doesn't mean compromising on quality, or support. Get a cheap car insurance quote online from Mercury Insurance today. Based on our research, Auto-Owners offers the cheapest minimum coverage car insurance rates for high-risk drivers who have one speeding ticket conviction. felo-gert.ru is a free insurance comparison website that offers drivers across the country real-time, accurate rates from top insurance companies in the United. Your rates are based on several factors, including the coverages you select, your age, ZIP code, and driving history. Comparing quotes from several insurance. We're here to help you understand your options and make the best choice for your auto insurance needs. Get your FREE car insurance quote with GEICO now. Geico has the cheapest car insurance for most good drivers in California. Drivers who have never had an accident or received a citation are considered good. We'll see how we can provide you with an affordable auto insurance policy that meets your specific requirements. In fact, we work hard to help drivers find a. Get all your vehicle insurance quotes right here. All we need is your zip code and a few details to get you all the cheap car insurance quotes you need, in one. Nationwide was second cheapest at $95 per month. Actual rates vary by driver profile and location, so find the cheapest full coverage in your state below. Enter.

Best Bank To Get Personal Loan With Bad Credit

Best bad credit loans · Upgrade: Best for long repayment terms. · LendingPoint: Best for fast funding. · LendingClub: Best for co-borrowers. · Prosper: Best for. Personal Loans. as low as. 8. APR1. Get the money you need within hours. Get. If you have bad credit, a secured loan could be an option for you because it helps lower the risk for the lender. With no application or early repayment fees, a USAA Bank personal loan is a good alternative to using a higher interest credit card. We offer loans from. For example, many online lenders offer personal loans to borrowers with less-than-perfect credit. Another option is to get a secured loan, which uses collateral. Those looking for poor or bad credit loans in Canada will often find AimFinance as an option. When you have a less than perfect credit score and can use funds. Best for people without a credit history: Upstart Personal Loans ; Best for debt consolidation: Happy Money ; Best for flexible terms: OneMain Financial Personal. loan amounts may need to be lower than fair or good credit loans. Knowing what you need for approval and then comparing lenders is the best way to get a bad. Whether you have good credit, bad credit or something in between, FCU has personal loans designed for you¹. No collateral is required, applying is easy, and. Best bad credit loans · Upgrade: Best for long repayment terms. · LendingPoint: Best for fast funding. · LendingClub: Best for co-borrowers. · Prosper: Best for. Personal Loans. as low as. 8. APR1. Get the money you need within hours. Get. If you have bad credit, a secured loan could be an option for you because it helps lower the risk for the lender. With no application or early repayment fees, a USAA Bank personal loan is a good alternative to using a higher interest credit card. We offer loans from. For example, many online lenders offer personal loans to borrowers with less-than-perfect credit. Another option is to get a secured loan, which uses collateral. Those looking for poor or bad credit loans in Canada will often find AimFinance as an option. When you have a less than perfect credit score and can use funds. Best for people without a credit history: Upstart Personal Loans ; Best for debt consolidation: Happy Money ; Best for flexible terms: OneMain Financial Personal. loan amounts may need to be lower than fair or good credit loans. Knowing what you need for approval and then comparing lenders is the best way to get a bad. Whether you have good credit, bad credit or something in between, FCU has personal loans designed for you¹. No collateral is required, applying is easy, and.

Below you will find a list of our most trusted lending companies that work with poor credit or no credit situations. Bad credit personal loans in Canada can be. Knowing what you need for approval and then comparing lenders is the best way to get a bad credit personal loan if you have a low credit score. A personal loan is best for one-time funding, or if you know the entire cost of your project up front. You receive the loan in one lump sum. Whether you need a small personal loan, or you're working to improve bad credit, PFCU offers low rates and fast approval. According to our research, Upgrade is the best provider for bad credit loans because it offers a high borrowing limit, long loan terms, fast loan disbursement. Explore our small business financing options and find out how to use small business loans and credit to finance your business needs. Get more information. Home Improvement Loan · Personal Line of Credit. Get access to cash at a low interest rate to cover unexpected expenses or just give your bank account some extra. Offered by Happy Money, the Payoff personal loan is specifically designed for credit card debt consolidation. Loans range from $5, to $40,, with repayment. interest rates range from % to %. The most credit worthy applicants may qualify for a lower rate while longer-term loans may have higher rates. The. Lenders and loan programs have unique eligibility requirements. In Even those with bad credit may qualify for startup funding. The lender will. A Personal Unsecured Installment Loan from PNC provides you access to the money you need without requiring collateral. Apply for an unsecured personal loan. Compare bad credit loan rates from top lenders for September · LightStream Personal Loans · Upstart Personal Loans · Discover Personal Loans · LendingClub. The best personal loans for bad credit are through Upstart. Personal loans through Upstart have dollar amounts of $1, - $50,, a typical APR range of %. Bad credit personal loans with no credit check. If your credit score is very low (or non-existent), it might be worthwhile to seek out a lender who will approve. Some lenders specialize in PLOCs for bad credit, so you might qualify with a low score. However, that doesn't mean that rates will be affordable. On top of. Some lenders that cater to borrowers with poor credit have low loan maximums, but Upgrade allows borrowers to apply for as much as $50, And it requires a. With low rates and flexible terms, our personal loan options help you manage unplanned expenses or get some extra cash. Our simple online application and digital banking* options make it easy to manage your personal loan. Member Benefits. Navy Federal members receive exclusive. Bad credit loans are personal loans specifically designed for borrowers with poor credit. FICO defines a “poor” credit score as one below , but most personal. > Getting Instant Approval Loans with Bad Credit; > What are Bad Credit Loans? > Guaranteed Approval Loans for Poor Credit in Canada; >.

Can You Start Trading With 100 Dollars

There is a popular belief among traders that you can start Forex trading with a little amount of money and become a multimillionaire in just a few weeks. what I said $ not $, well you can try to reach. which are Real Estate Investment Trust. there are companies that own income producing assets. like. Yes, if you buy low and sell high you can make money. Problem is, you never know when it's at a low and it's time to buy, or when it's at a high. Because the $25, portfolio value requirement is set by FINRA, all brokerages are required to enforce it. For more information, you can learn about day. Take advantage of our $ no deposit bonus and start trading forex without risking your own money You can trade both upwards and downwards price movements. Are you interested in turning a small investment of $ into a substantial profit of $ in the forex market? Yes, you can start trading with $, but there are some important considerations to keep in mind: 1. Broker Minimums: Some brokers have minimum deposit. Start with $ using only PA and trading 1 minilot w/ leverage I have been a follower of James 16 thread. I come from a developing country,Kenya and i. Start small: Begin with a modest deposit ($$) for a low-risk introduction to trading. Define routine: Set a daily routine aligned with. There is a popular belief among traders that you can start Forex trading with a little amount of money and become a multimillionaire in just a few weeks. what I said $ not $, well you can try to reach. which are Real Estate Investment Trust. there are companies that own income producing assets. like. Yes, if you buy low and sell high you can make money. Problem is, you never know when it's at a low and it's time to buy, or when it's at a high. Because the $25, portfolio value requirement is set by FINRA, all brokerages are required to enforce it. For more information, you can learn about day. Take advantage of our $ no deposit bonus and start trading forex without risking your own money You can trade both upwards and downwards price movements. Are you interested in turning a small investment of $ into a substantial profit of $ in the forex market? Yes, you can start trading with $, but there are some important considerations to keep in mind: 1. Broker Minimums: Some brokers have minimum deposit. Start with $ using only PA and trading 1 minilot w/ leverage I have been a follower of James 16 thread. I come from a developing country,Kenya and i. Start small: Begin with a modest deposit ($$) for a low-risk introduction to trading. Define routine: Set a daily routine aligned with.

Currencies trade against each other as exchange rate pairs. For example, EUR/USD is a currency pair for trading the euro against the U.S. dollar. Forex markets. Can you trade forex with $? You can. However, your options will be limited, and unless you trade recklessly (which is not recommended and could set the. NinjaTrader offers exclusive software for futures trading. With our modern trading platform, you will control every step of your trading journey. As with any trade, you should identify your entry and exit points before you begin. However, if the stock suddenly rises to $ per share, you'll need. With the advent of micro, mini and nano lot sizes it is certainly possible to open a Forex account with just $ Many brokers accept amounts as low as $10 and. Trading with only $ may seem impossible. The risk for a single trade should be below 5%, no matter how big your deposit is. Let's go with a 3% risk ($3). You can start trading with $ You must admit that this is a relatively small amount of money for an average person. It is not enough to invest the money. To. Chances are, you'll want to start investing with one of these 3 main account types: Brokerage account: When people talk about trading stocks, they're typically. A day trade occurs when you open and close a position within a single trading day. These types of trades can include. In fact, you can start trading with as little as $ When you're a beginner this might actually be an excellent way to start because you'll be able to. If you wish to trade the forex market, $ will get you started and may even provide you with a new source of income from the comfort of your own home. Your. You can see how starting with only $ severely limits how you trade forex. By risking a small dollar amount, you only make small gains by extension when. Start investing today with the Schwab Starter Kit. Get $ invested equally in the top 5 stocks. Learn how to manage with tools and resources provided! Take advantage of our $ no deposit bonus and start trading forex without risking your own money You can trade both upwards and downwards price movements. Many Forex traders start with as little as $, while others may start with more, depending on their goals and strategies. One thing to keep in mind, however. Apparently, $25, to $50, is the required trading account size to make $ a day based on my criteria. What If You Don't Have That Required Trading. At a minimum, these studies indicate at least 50% of aspiring day traders will not be profitable. This reiterates that consistently making money trading stocks. With only $, you can start trading Forex and begin to see profits, then very soon, you'll be trading Forex with dollars and will continue growing your. At a minimum, these studies indicate at least 50% of aspiring day traders will not be profitable. This reiterates that consistently making money trading stocks.

How Much Can A Credit Card Garnish Your Wages

Generally, any creditor can garnish your wages. But some creditors must meet more requirements before doing so. Can my wages be garnished for collection of a judgment in South Carolina? Your wages CANNOT be garnished for collection of a debt or a judgment incurred here in. If disposable earnings are $ or more, a maximum of 25% can be garnished. When pay periods cover more than one week, multiples of the weekly restrictions must. Your wages are only protected for 60 days after they are deposited in your account so it would be helpful if you immediately send the undersigned creditor a. Your creditor cannot garnish your wages or bank account unless there has been a judgment entered against you. Your creditor must first sue you in court. If the. In other words, your wages can't be garnished if you make less than $ weekly disposable earnings. What Is the Link Between Wage Garnishment and Credit. In New York, a creditor can garnish the lesser of 10% of your gross wages or 25% of your disposable income to the extent that this amount exceeds 30 times the. Under federal law, up to 50 percent of your disposable earnings can be taken if you are currently supporting a spouse or child that is the subject of the child. Before a creditor can start to garnish your wages or bank account, it must first have started a lawsuit to collect money that it claims you owe. If the creditor. Generally, any creditor can garnish your wages. But some creditors must meet more requirements before doing so. Can my wages be garnished for collection of a judgment in South Carolina? Your wages CANNOT be garnished for collection of a debt or a judgment incurred here in. If disposable earnings are $ or more, a maximum of 25% can be garnished. When pay periods cover more than one week, multiples of the weekly restrictions must. Your wages are only protected for 60 days after they are deposited in your account so it would be helpful if you immediately send the undersigned creditor a. Your creditor cannot garnish your wages or bank account unless there has been a judgment entered against you. Your creditor must first sue you in court. If the. In other words, your wages can't be garnished if you make less than $ weekly disposable earnings. What Is the Link Between Wage Garnishment and Credit. In New York, a creditor can garnish the lesser of 10% of your gross wages or 25% of your disposable income to the extent that this amount exceeds 30 times the. Under federal law, up to 50 percent of your disposable earnings can be taken if you are currently supporting a spouse or child that is the subject of the child. Before a creditor can start to garnish your wages or bank account, it must first have started a lawsuit to collect money that it claims you owe. If the creditor.

The portion of your wages that can be garnished to settle private debts — such as credit cards, medical bills, bank loans, and private student loans — depends. The law sets certain limits on how much debt collectors can garnish your wages and bank accounts. Certain federal benefits, such as social security benefits. If you owe money from a payday loan, credit card, personal loan or medical bill, and you do not pay then they may eventually file a lawsuit in court, obtain a. Social Security income can't be garnished to pay credit card or other commercial debt. loan much less costly than paying high-interest revolving credit card. If it is for family maintenance (child support, alimony, palimony), they will take 50% of your GROSS wages. The garnishment will continue every. No. A creditor cannot garnish % of your earnings or wages. The Kansas Supreme Court recently held that a creditor could not use a non-wage garnishment of. How Much Of My Gross Wages Are Garnished? · Garnishments based out-of-state: up to 25% of disposable income · Child support: up to 50% of your disposable income. In other words, your wages can't be garnished if you make less than $ weekly disposable earnings. What Is the Link Between Wage Garnishment and Credit. What is the process to garnish the wages of a civilian federal employee for a commercial debt? The creditor must serve garnishment documents on DFAS at the. Title III protects employees from being discharged by their employers because their wages have been garnished for any one debt and limits the amount of. How much can they garnish? A Writ of Continuing Garnishment lets a creditor take 25% of your disposable earnings. You can read the Garnishee's Answers to. Under federal law, up to 50 percent of your disposable earnings can be taken if you are currently supporting a spouse or child that is the subject of the child. Under the federal law, the maximum amount that might be garnished is the lesser of (1) 25% of weekly disposable earnings or (2) the amount by which weekly. For student loans, up to 15% of disposable income or 30 times the minimum wage can be garnished. For federal back taxes, the amount withheld depends on the. Wages may not be garnished by more than one creditor at a time unless the primary garnishment does not take the full 25% allowed by law. (These garnishment. Are there any limitations on how much a creditor can collect from the debtor's paycheck? A creditor may not garnish more than 25% of your wages per pay period. The creditor will sell your If a debt collector threatens to take your home or garnish your wages, you may be the victim of a debt collection scam. A wage garnishment doesn't mean that we will garnish all your wages. The notice instructs the garnishee to withhold up to 25 percent of your take home wages. Your score hit is due to the collection on your credit report. That will likely stay on for 7 years since the date of first delinquency. Are there any limitations on how much a creditor can collect from the debtor's paycheck? A creditor may not garnish more than 25% of your wages per pay period.

Average Credit Score For A House

For a conventional loan (one that conforms to Fannie Mae or Freddie Mac guidelines), the minimum is For a government-insured FHA loan with. Yes, you can get a mortgage with a credit score of This score sits between a Fair and Excellent credit rating, depending on which credit reference agency. The average credit score is and most Americans have Most lenders require a minimum credit score of to buy a house with a conventional mortgage. “FHA loans allow you to have a credit score of or higher and still be able to put only % down,” says Garett Seney, a mortgage advisor with Fairway in. For those interested in applying for an FHA loan, applicants are now required to have a minimum FICO score of to qualify for the low down payment advantage. All three of your scores usually don't need to be to qualify for a conventional loan. But most lenders want your “middle credit score” to be or higher. Typically, you will need a credit score of at least to get a mortgage. Sometimes, you may qualify for a government-backed loan with a lower credit score. If. Borrower 1. Borrower 2. Scores: , Median = Scores: , , Median = Average: (+)/2 = Representative credit score = CNBC Select rounded up lenders that may be best for those with average or fair credit scores and evaluated each lender based on the types of loans offered. For a conventional loan (one that conforms to Fannie Mae or Freddie Mac guidelines), the minimum is For a government-insured FHA loan with. Yes, you can get a mortgage with a credit score of This score sits between a Fair and Excellent credit rating, depending on which credit reference agency. The average credit score is and most Americans have Most lenders require a minimum credit score of to buy a house with a conventional mortgage. “FHA loans allow you to have a credit score of or higher and still be able to put only % down,” says Garett Seney, a mortgage advisor with Fairway in. For those interested in applying for an FHA loan, applicants are now required to have a minimum FICO score of to qualify for the low down payment advantage. All three of your scores usually don't need to be to qualify for a conventional loan. But most lenders want your “middle credit score” to be or higher. Typically, you will need a credit score of at least to get a mortgage. Sometimes, you may qualify for a government-backed loan with a lower credit score. If. Borrower 1. Borrower 2. Scores: , Median = Scores: , , Median = Average: (+)/2 = Representative credit score = CNBC Select rounded up lenders that may be best for those with average or fair credit scores and evaluated each lender based on the types of loans offered.

Credit score requirements vary from lender to lender. However, for most conventional mortgages, homebuyers need a minimum credit score of for approval. If. In this case, the average score would be , raising the couple's average above the minimum. Here's how it would work. Lenders use the borrowers' "middle. FHA loans are beneficial to first-time homebuyers because they accept applicants with a minimum credit score requirement of as low as According to Experian. The minimum credit score needed to purchase a home can be anywhere from to depending on the type of mortgage. The information provided on this. A credit score between and is needed for a home loan, but a higher credit score will lead to a lower mortgage interest rate and monthly payment. Mortgage rates as of August 22, ; % · % · % · % ; $1, · $1, · $1, · $1, In fact, the term “subprime mortgage” refers to mortgages made to borrowers with credit scores below (some say below or even ). In these cases. You need a minimum of to qualify for a government-backed loan by Fannie Mae and Freddie Mac. However, the government, in all its wisdom, allows you to. Usually a is the average, but in some cases lenders will go as low as VA loans are insured by the federal where they guarantee a portion of each loan. Depends on the type of loan you want to get. If you are opting for FHA/VA, the minimum is or above. If you want conventional, the minimum is. Borrowers applying for conventional mortgage loans might need a credit score of or higher to qualify. · Requirements for government-backed loans—like FHA. The average credit score in the US is , but this score varies in each state. Compare your credit score with your state's average score and learn more. Ages 18 to Average FICO score of In general, average credit scores increase with older groups. Older people have had more time to establish credit. In general, a credit score above will allow potential mortgage borrowers access to prime or favorable interest rates on their loan. · Scores below are. Credit Score Requirements as Low as FHA loans are the #1 loan type in America. Many people who can afford the monthly mortgage payments and have reasonable. No universal minimum credit score requirement exists for mortgage loan eligibility. The credit score requirements vary based on the category of the loan, the. The average credit score for borrowers between the ages of 50 and 59 years old is By this time people often have a very long credit history and a full. Average FICO Credit Score For Denied Mortgage Applicants. The average credit score for recently denied applications on conventional purchase loans is A FICO score is the absolute minimum allowed for home loans backed by Fannie Mae and Freddie Mac. But there are some exceptions for nontraditional credit .

Basic Vs Powertrain Warranty

A separate powertrain warranty covers the mechanical parts that move the car and usually lasts several years, or several years' worth of driving, longer than. WARRANTY ; BASIC WARRANTY. 48MO / 50K MI ; POWERTRAIN WARRANTY. 72MO / 70K MI ; HYBRID WARRANTY. 8YR / K MI. As you can see, powertrain warranties are more limited. They don't include electronics, heating and cooling systems, and many other components. Powertrain. Learn more about the Cadillac Bumper-to-Bumper Warranty, Powertrain Limited Warranty, and all the other warranties offered by Cadillac Escalade-V limited. Powertrain warranties are specific subset of INCLUSIVE warranties. There is a statement of warranty that INCLUDES only specific parts, typically. year/,mile limited powertrain warranty · 5-year/60,mile limited basic warranty · 5-year/,mile limited anti-perforation warranty · 5-year/. The basic limited warranty is the first line of warranty coverage you receive after buying your Kia. It covers all components of your Kia for 60 months or. When it comes to manufacturer powertrain warranties, the covered components only include the engine, transmission, and drivetrain - not. The 5-year/60,mile basic warranty covers basically everything except maintenance, wear-and-tear and external damage to your vehicle. This warranty is. A separate powertrain warranty covers the mechanical parts that move the car and usually lasts several years, or several years' worth of driving, longer than. WARRANTY ; BASIC WARRANTY. 48MO / 50K MI ; POWERTRAIN WARRANTY. 72MO / 70K MI ; HYBRID WARRANTY. 8YR / K MI. As you can see, powertrain warranties are more limited. They don't include electronics, heating and cooling systems, and many other components. Powertrain. Learn more about the Cadillac Bumper-to-Bumper Warranty, Powertrain Limited Warranty, and all the other warranties offered by Cadillac Escalade-V limited. Powertrain warranties are specific subset of INCLUSIVE warranties. There is a statement of warranty that INCLUDES only specific parts, typically. year/,mile limited powertrain warranty · 5-year/60,mile limited basic warranty · 5-year/,mile limited anti-perforation warranty · 5-year/. The basic limited warranty is the first line of warranty coverage you receive after buying your Kia. It covers all components of your Kia for 60 months or. When it comes to manufacturer powertrain warranties, the covered components only include the engine, transmission, and drivetrain - not. The 5-year/60,mile basic warranty covers basically everything except maintenance, wear-and-tear and external damage to your vehicle. This warranty is.

A powertrain warranty protects the mechanical components that propel your car forward. These parts tend to be the most expensive to repair or replace. Before. The Basic Warranty is a limited Kia bumper-to-bumper warranty and doesn't cover wear or maintenance items. What is the Kia Powertrain Warranty? The Kia. year/, mile limited powertrain warranty. · 5-year/60, mile limited basic warranty. · 5-year/, mile limited anti-perforation warranty. · 5-year/. Covers routine maintenance and parts replacement for the engine, transmission, transaxle, drivetrain, and restraint system. Honda Corrosion Limited Warranty –. Powertrain warranties combine engine coverage with drivetrain coverage. What does a powertrain warranty cover? Powertrain warranties cover specific components. As you can see, powertrain warranties are more limited. They don't include electronics, heating and cooling systems, and many other components. Powertrain. The warranty typically includes a new vehicle limited warranty, although it may also include a powertrain warranty and other coverage. Honda HR-V vs. Powertrain warrantee covers the engine, transmission, differential and axles. A drive train warrantee doesn't usually cover the engine. A bumper. A comprehensive warranty, though, are very different. They tend to cover much more. Items such as the air conditioning, springs, and even seat material might be. powertrain warranty will make it a breeze to keep your engine running smoothly. The Kia bumper-to-bumper warranty—also known as your “basic” or. This means the engine, the transmission, the drive axles, etc. This warranty is often longer than the bumper-to-bumper variety and is equally important, as the. Powertrain Coverage is 60 months/60, miles, whichever occurs first, from the date of first use and includes engine, transmission/transaxle, front-wheel-drive. Scope of Coverage: The most significant difference lies in what each warranty covers. A powertrain warranty is more limited, focusing on essential components. Second and/or subsequent owners have powertrain components coverage under the 5-Year/60,Mile New Vehicle Limited Warranty. Excludes coverage for vehicles in. Vehicle Warranties By Make ; Kia Warranty (7/ and later), 5 years/60, miles, 10 years/, miles ; Lexus Warranty, 4 years/50, miles, 6 years/70, A powertrain warranty covers the single most important part of a car: what makes it go. There isn't a single component of the powertrain that's inexpensive to. year/, mile limited powertrain warranty · 5-year/60, mile limited basic warranty · 5-year/, mile limited anti-perforation warranty · 5-year/. A powertrain warranty covers essential systems such as the engine and transmission and is considered minimal stated-component coverage. Covered systems include. For example, one warranty might offer bumper-to-bumper coverage for 3 years/36, miles, but will continue to cover the powertrain until 5 years/60, miles. Typical powertrain warranties last for 5 years or 60, miles, whichever comes first, but other durations are available. Covered components include: Engine —.

Highest Volatility Forex Pairs

Top 10 Most Volatile Currency Pairs in ; USD/ZAR, US Dollar/South African Rand ; USD/BRL, US Dollar/Brazilian Real ; CAD/JPY, British Pound/Japanese Yen ; GBP/. Cryptocurrencies are often regarded as the most volatile market. Stellar, Ripple, Ethereum, and Bitcoin are among the most volatile cryptocurrencies. In the. The Most Volatile Currency Pairs · AUD/JPY (average volatility – %); · AUD/USD (average volatility – %); · EUR/AUD (average volatility – %); · NZD/. In this comprehensive guide, we will explore the top 10 most volatile currency pairs in forex, shedding light on the factors influencing their volatility. NZD/USD, GBP/JPY, and AUD/USD are also the most volatile pairs. This means that the average candle on these pairs' charts is likely to be longer than that of. The EUR/USD is the most traded of all forex pairs in the world. That's largely because it is the two biggest western economies trading against one another. GBP/. He asked for my opinion and I gave it to him. Other currencies may move more but if there's one pair that moves a lot, commonly traded, low. What are the most and least volatile currencies in the forex market today? The most volatile forex pairs fluctuate significantly within a given period, while the least volatile ones undergo minor price movements. Top 10 Most Volatile Currency Pairs in ; USD/ZAR, US Dollar/South African Rand ; USD/BRL, US Dollar/Brazilian Real ; CAD/JPY, British Pound/Japanese Yen ; GBP/. Cryptocurrencies are often regarded as the most volatile market. Stellar, Ripple, Ethereum, and Bitcoin are among the most volatile cryptocurrencies. In the. The Most Volatile Currency Pairs · AUD/JPY (average volatility – %); · AUD/USD (average volatility – %); · EUR/AUD (average volatility – %); · NZD/. In this comprehensive guide, we will explore the top 10 most volatile currency pairs in forex, shedding light on the factors influencing their volatility. NZD/USD, GBP/JPY, and AUD/USD are also the most volatile pairs. This means that the average candle on these pairs' charts is likely to be longer than that of. The EUR/USD is the most traded of all forex pairs in the world. That's largely because it is the two biggest western economies trading against one another. GBP/. He asked for my opinion and I gave it to him. Other currencies may move more but if there's one pair that moves a lot, commonly traded, low. What are the most and least volatile currencies in the forex market today? The most volatile forex pairs fluctuate significantly within a given period, while the least volatile ones undergo minor price movements.

A pair of currencies - one from an economy that's primarily commodity-dependent, the other a services-based economy - will tend to be more volatile because of. In Forex market the most volatile Forex pairs among the major currencies are AUD/USD, USD/JPY, and GBP/USD, among the exotics currencies. The five most volatile currencies in are the US Dollar (USD), Euro (EUR), British Pound (GBP), Japanese Yen (JPY), and Russian Ruble (RUB). The most volatile currency pairs are the exotic ones. In terms of cross rates, The most volatile currency pairs are: GBP/NZD, GBP/AUD, GBP/CAD, GDP/JPY. In Forex, GBP/JPY is the most volatile trading pair, on the other hand, Gold metal is too much volatile! Basically, volatile trading instruments are useful for. When there is high volatility in the market and currency pair prices are touching constant high prices, it indicates a bearish market sentiment (short/sell. The most volatile currency pairs have greater chances of significant price movements in both directions, increasing trade opportunities and potential profits. Why Is the EUR/USD the Most Popular Currency Pair? The U.S. currency is the most actively traded currency in the world. The euro is also highly traded. The. There are different ways to measure volatility, but one of the best-known indicators for this purpose is the Average True Range (ATR). The ATR indicator was. In this blog post, we will explore the concept of volatility and discuss some of the most volatile currency pairs in the Forex market. Latest forex price quotes as of Fri, Aug 23rd, Price Surprises lists the most volatile forex, ranked by standard deviation compared to their past 20 of. As we move into , here is an overview of some of the most volatile currency pairs that traders should monitor closely. Example: USD/ ZAR (US Dollar/ South African rand) is known for its volatility, but it may have lower liquidity compared to major pairs like EUR/USD or USD/JPY. Daily and monthly volatility: The GBP/USD pair typically experiences an average daily pip movement of approximately pips and a monthly pip movement of. On average, various currency pairings have varied amounts of volatility. Some traders prefer trading volatile currency pairings because of the larger potential. EUR/USD – or the 'fibre' – is widely considered the most popular forex pair as it typically comes with the highest volume and among the lowest spreads. In forex trading, the volatility measures the comparison of two currencies, and high volatility will mean a vast fluctuation in the price. Volatility for the. The most volatile currency pairs are not the most popular Forex pairs EURUSD, GBPUSD, USDJPY. These are the Forex currency pairs that are most traded. In fact, EURUSD is the most traded currency pair in the world that takes about 30% of the total multi-billion dollar Forex turnover. And it is not surprising.

Mortgage Rates At Banks

Fixed-rate loan ; 1 year. %. % ; 2 years. % ; 3 years. % ; 4 years. % see the promo. Mortgage Rates ; APR · 15 Year, %, %, $ ; APR · 15 Year (Up to 80% LTV), %, %, $ ; APR1 (based on year term) · 3/6 ARM, %, %. Find the mortgage type and term that's right for you ; 3-YEAR FIXED · % · % ; 3-Year Variable · % · % ; 5-YEAR FIXED · % · % ; 5-year fixed high-. The current average year fixed mortgage rate fell 5 basis points from % to % on Monday, Zillow announced. The year fixed mortgage rate on August. Monthly principal and interest payments will be $ with a corresponding interest rate of %. HSBC Deluxe Mortgage 10/6 ARM: The total repayment term. Mortgage Rates. Competitive Rates. Unmatched Service. Find mortgage rates that work perfectly for you. Choose from 3- to year closed term fixed rate mortgages and variable rate mortgages at felo-gert.ru For example: a year fixed rate loan of $, at % will have principal and interest of $1, per month. ^ Back to rates. 3) Construction Only Loans. As of August 21, , five-year fixed rates are below % at some brokerages, while three-year fixed rates can be found for less than %. After the Bank of. Fixed-rate loan ; 1 year. %. % ; 2 years. % ; 3 years. % ; 4 years. % see the promo. Mortgage Rates ; APR · 15 Year, %, %, $ ; APR · 15 Year (Up to 80% LTV), %, %, $ ; APR1 (based on year term) · 3/6 ARM, %, %. Find the mortgage type and term that's right for you ; 3-YEAR FIXED · % · % ; 3-Year Variable · % · % ; 5-YEAR FIXED · % · % ; 5-year fixed high-. The current average year fixed mortgage rate fell 5 basis points from % to % on Monday, Zillow announced. The year fixed mortgage rate on August. Monthly principal and interest payments will be $ with a corresponding interest rate of %. HSBC Deluxe Mortgage 10/6 ARM: The total repayment term. Mortgage Rates. Competitive Rates. Unmatched Service. Find mortgage rates that work perfectly for you. Choose from 3- to year closed term fixed rate mortgages and variable rate mortgages at felo-gert.ru For example: a year fixed rate loan of $, at % will have principal and interest of $1, per month. ^ Back to rates. 3) Construction Only Loans. As of August 21, , five-year fixed rates are below % at some brokerages, while three-year fixed rates can be found for less than %. After the Bank of.

Today's Mortgage Rates* ; 15 Year Fixed, %, % ; 20 Year Fixed, %, % ; 30 Year Fixed, %, % ; 5/1 ARM, %, %. Construction Loans: Rate shown is based on a $, loan amount for 12 months, interest payable monthly on advances made and a 20% down payment, 1–4-unit. View the daily rates for our mortgage products. We can help you go from dream to reality. A fixed rate loan of $, for 20 years at % interest and % APR will have a monthly payment of $1, A fixed rate loan of $, for Today's Special Mortgage Rates ; 3 Year Fixed · Amortization · % ; 5 Year Smart Fixed · Default insured mortgage · % ; 5 Year Smart Fixed · Amortization · %. year fixed, % (%), $ added to closing costs, $2, ; year fixed, % (%), $32 credit to closing costs, $2, View daily mortgage and refinance interest rates for a variety of mortgage and home loans from Truist. Including rates for fixed, adjustable, FHA & VA. Today's featured refinance mortgage rates · Jumbo Loans. 10 Year ARM. % % APR · Conforming Loans. 10 Year ARM. % % APR. Mortgage rates today · yr fixed. Rate. %. APR. %. Points (cost). ($3,). Term. yr fixed. Rate · yr fixed FHA. Rate. %. APR. %. Conventional Fixed Rate ; 30 Year, % · % ; 30 Year, % · % ; 20 Year, % · % ; 20 Year, % · % ; 15 Year, % · %. As of August 26, , the best mortgage rates in Canada are: 5-year fixed at %, 3-year fixed at %, and 5-year variable at %. The data shown is to provide information on the weekly posted interest rates offered by the six major chartered banks in Canada. The posted rates cover prime. Mortgage Rates ; 30 Year Fixed Monthly, %, 0 ; 15 Year Fixed Monthly, %, ; 15 Year Fixed Monthly, %, 0 ; 30 Year Fixed FHA, % Mortgage Rates ; based on monthly payments, NH only. %. % ; based on monthly payments 1% Initial / 1% Annual / 5% Lifetime Cap. %. Fremont Bank offers best-in-class rates on mortgages, refinance and home equity lines of credit. Check out our rates and contact us today for more. payments of $1, at an interest rate of %; 1 payment of $1, at an interest rate of %. If an escrow account is required or requested. Interest costs over 30 years Over 30 years, an interest rate of % costs $, more than an interest rate of %. With the adjustable-rate mortgage. Compare rates and choose the best mortgage for your needs. Serving NEPA and Lehigh Valley. All loans are provided by PNC Bank, National Association, a subsidiary of PNC, and are subject to credit approval and property appraisal. equal housing lender. Example based on $, loan amount at an interest rate of % for the initial month period, and a rate of % after the initial period. Payments do.

Fast Verify Request Loan Legit

Payday loans can be a viable option when you need money fast. But any situation in which money is involved — and consumers feel pressured — is a perfect target. Fast, Secure Digital Verification Services · Fast, Secure Digital Verification Services for Auto Lenders · I'm a Verifier Representing a Business · I'm an Employee. Fast verify requests can be reliable, provided they are implemented using robust security measures and adhere to regulatory standards. Are there. Legitimate lenders typically advertise in ways you would expect, such as online or through other mass media. If you get a loan offer by phone, through the mail. felo-gert.ru is very likely not a scam but legit and reliable. Our algorithm gave the review of felo-gert.ru a relatively high score. How to identify a student loan scam · They require payment before they'll help · They request sensitive information · They claim to be affiliated with the. If a lender does ask for payment before you access your loan funds, this is almost always a sign of a scam. This is how personal loans work: When you pay back a. There's no such thing as a guaranteed loan. For approval, a lender will typically check your credit and verify your information. Scammers lure you in with. If an online loan company deposits money into your account, but asks for some or all of the money back, this is almost surely a sign of a scam. Criminals use a. Payday loans can be a viable option when you need money fast. But any situation in which money is involved — and consumers feel pressured — is a perfect target. Fast, Secure Digital Verification Services · Fast, Secure Digital Verification Services for Auto Lenders · I'm a Verifier Representing a Business · I'm an Employee. Fast verify requests can be reliable, provided they are implemented using robust security measures and adhere to regulatory standards. Are there. Legitimate lenders typically advertise in ways you would expect, such as online or through other mass media. If you get a loan offer by phone, through the mail. felo-gert.ru is very likely not a scam but legit and reliable. Our algorithm gave the review of felo-gert.ru a relatively high score. How to identify a student loan scam · They require payment before they'll help · They request sensitive information · They claim to be affiliated with the. If a lender does ask for payment before you access your loan funds, this is almost always a sign of a scam. This is how personal loans work: When you pay back a. There's no such thing as a guaranteed loan. For approval, a lender will typically check your credit and verify your information. Scammers lure you in with. If an online loan company deposits money into your account, but asks for some or all of the money back, this is almost surely a sign of a scam. Criminals use a.

Fakes, Frauds and Phonies: Fraudulent Income and Employment Data in Mortgage Loan Applications Are Bad for the Industry, Brokers, Lenders and Borrowers. By. Rocket Loans is an online finance company offering low rate personal loans from $ to $ Check out options in minutes without affecting your credit. As long as you're able to access the internet, you'll be able to apply for legit loans through MoneyKey. check_circle. Fast Approval◇. Verify your info with. This is legit, with one major clarification. When you utilize the 'be your own bank strategy' you are receiving a loan from an insurance company that uses the. It's a scam. A lender would never ask for this. They may seek a pdf printout of your statement but never access to your account. I also think it's probably legit, but is very poorly done. You can put in random numbers and get data on anybody, which seems like an insecure. They'll review your mortgage documents to see if your lender complied with the law. They say the audit can help you avoid foreclosure, speed the loan. Some Minnesotans have reported that fraudsters pretending to be debt collectors have contacted them to demand payment for an Internet payday loan or other. Unlike unsecured personal loans, secured loans require collateral. You have to provide property, money, or some other asset to secure the loan; if you don't. Don't ever give out personal information or agree to a loan over the phone or via the Internet. Government Grant and Loan Scam. This scam, like the advance fee. A scammer might also require unusual payment methods, such as a prepaid credit card that can't be tracked. Keep in mind that many legitimate personal loans come. Guaranteed approvals and upfront fees are two of the signs of a loan scam. Learn more about how to identify scams and ways you can protect yourself. RECOGNIZING THE SCAM The websites and ads offer easy access to loans, regardless of credit history. The advance-fee scammer may use a false business name and. Puppy or pet scam. A scammer creates a fake advertisement for a puppy or another type of pet. · Make money quick scam. A scammer requests money and says they'll. Scammers may pose as familiar companies or contacts and demand quick payment. Go slow and verify that the request is legitimate. Utility scams often. But seeking out unverified services is a common path to a student loan forgiveness scam. For all types of student loan forgiveness scams, act fast and follow. This organization is not BBB accredited. Loans in Atlanta, GA. See BBB rating, reviews, complaints, & more. Instantly verify applicants and reduce fraud with historical loan data and AI. Better verifications = faster onboarding, less fraud/risk. If the requirements seem way too easy, it could be a sign that it's a scam. What should I do if a fake Loan Company Scammed me? We have received a number of reports that there is a scam circulating where people are receiving calls and emails from people claiming to be Little-Loans.